Renters Insurance in and around Omaha

Omaha renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Omaha Renters!

Trying to sift through savings options and deductibles on top of family events, your pickleball league and keeping up with friends, can be overwhelming. But your belongings in your rented condo may need the impressive coverage that State Farm provides. So when the unexpected happens, your linens, furnishings and sound equipment have protection.

Omaha renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Why Renters In Omaha Choose State Farm

Renters often raise the question: Is renters insurance really necessary? Think for a moment about what it would cost to replace your stuff, or even just a few of your high-value items. With a State Farm renters policy by your side, you don't have to be afraid of windstorms or tornadoes. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've secured in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Matt Dougherty can help you add identity theft coverage with monitoring alerts and providing support.

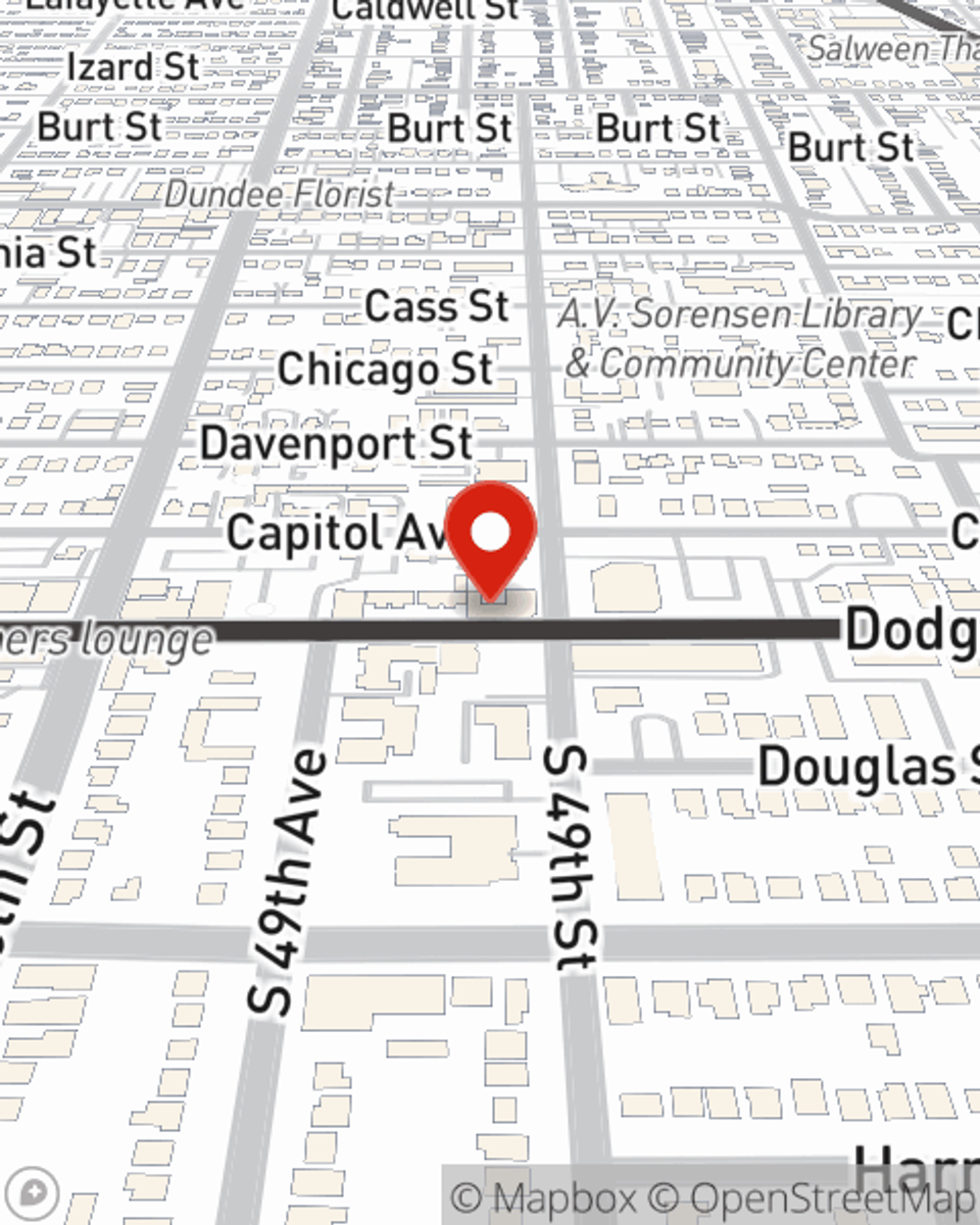

State Farm is a reliable provider of renters insurance in your neighborhood, Omaha. Contact agent Matt Dougherty today for help with all your renters insurance needs!

Have More Questions About Renters Insurance?

Call Matt at (402) 991-5757 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Matt Dougherty

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.